Welcome to Apocha

Why Apocha exists - a personal note

“Yet another expense tracker? Really?”

I've tried several money manager and budgeting apps, Excel spreadsheets, and so-called expense trackers. For me, the effort to enter data as detailed as I wanted was always far too high. They often look nice and are easy to use on the surface.

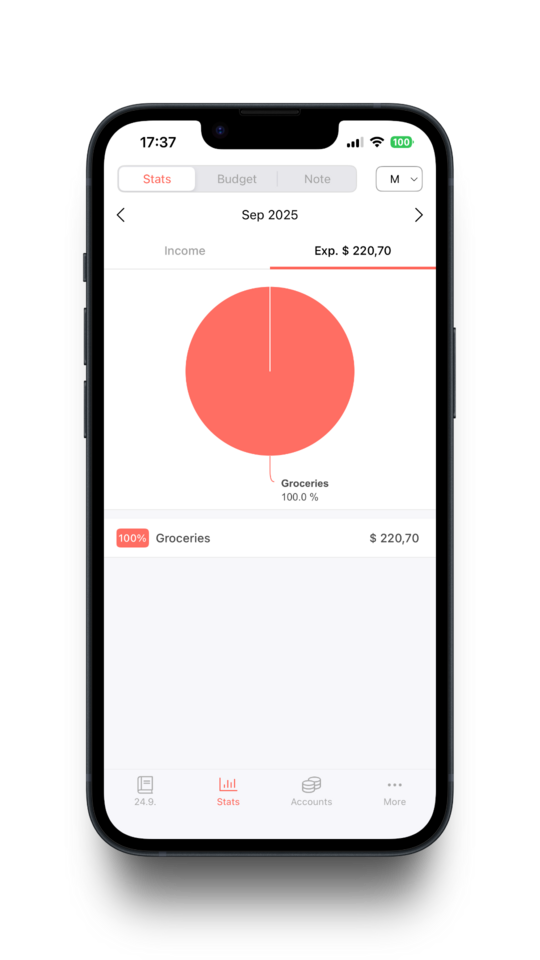

But things get complicated when you need to enter a large grocery haul, for example. I don't want to just write down "Supermarket, $220.70" or "Groceries, $220.70".

A large grocery run isn't just one category; the expenses are likely to fall into many individual categories like food, household supplies, toiletries, and pet food. This requires a lot of manual work with a calculator. This high effort always meant I only lasted a few weeks keeping a budget, if at all.

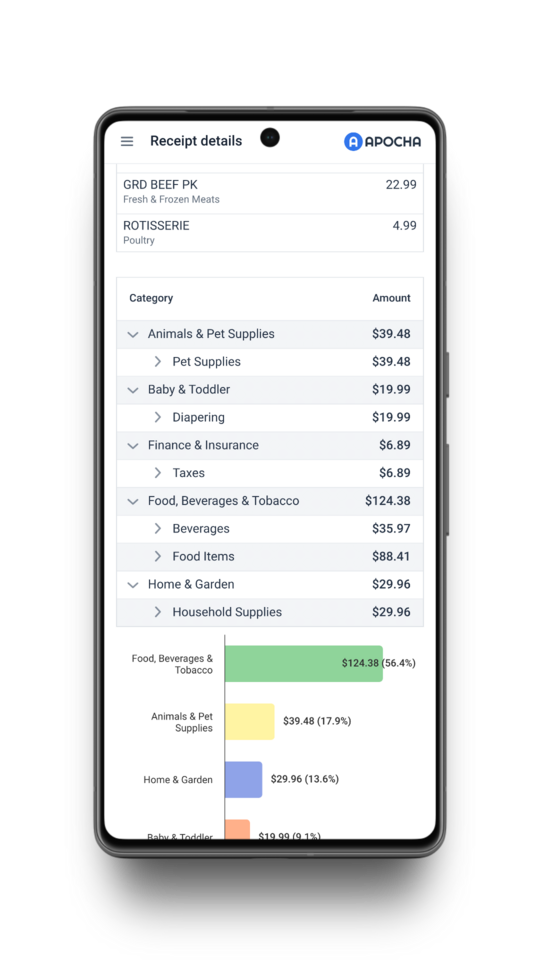

So, I started building my own solution. I wanted a budget app that could automatically sort every single item into the right categories with as little effort as possible. For example:

- Apples into "Food, Beverages & Tobacco > Food Items > Fruits & Vegetables > Fresh & Frozen Fruits > Apples"

- Cleaners into "Home & Garden > Household Supplies > Household Cleaning Supplies > Household Cleaning Products > All-Purpose Cleaners"

- Cat food into "Animals & Pet Supplies > Pet Supplies > Cat Supplies > Cat Food"

The idea was born: automatically analyze a photo of a receipt with software. After a lot of trial and error, tinkering, and programming, it worked quite well and was perfect for my needs.

Now, Apocha has over 5,500 hierarchical categories. This makes it possible to get a broad overview of your main spending areas while also seeing detailed breakdowns of where your money goes. And all of this is done automatically by snapping your paper receipt or sending digital receipts by mail.

Through discussions with others who wanted to manage their finances, I realized there were many more features people needed, like managing income, distinguishing between fixed and variable costs, setting up budgets, creating savings plans, and much more. This led to the idea of developing my small tool into what it is today. The goal of Apocha is to be the simplest, smartest, and most useful financial management app.

What is Apocha?

Today, Apocha is more than just an expense tracker. It’s a comprehensive financial management tool designed for anyone who wants a detailed, clear, and effortless overview of their finances. Whether you're a student, a freelancer, or managing a family budget, Apocha's powerful features help you go beyond simple tracking to truly understand your spending habits. Apocha gives you the precision without the pain.

Whether you're snapping a photo of a receipt or importing digital invoices, Apocha handles the heavy lifting so you can focus on understanding your finances.

As a so-called Progressive Web App (PWA), Apocha runs directly in your browser - no downloads required. It always delivers the latest version, syncs data across all your devices, and allows secure sharing with partners or family members.

Key Advantages Over Other Apps

Apocha stands out from other expense trackers, budgeting tools, and money management apps with its advanced features that reduce manual effort while providing much deeper insights:

-

Detailed Automatic Categorization: Uses a hierarchy of over 5,500 categories. Instead of lumping everything under "Shopping", Apocha breaks down receipt line items precisely, e.g., a T-shirt goes into "Apparel & Accessories > Clothing > Shirts & Tops > Shirts".

-

Email-Based Imports: Forward digital receipts and invoices directly to your Apocha account, or set up automatic rules for recurring emails (e.g., from online stores or utilities). That way it's just a minute from buying at Amazon to a fully categorized receipt entry in apocha - fully automatic without a manual task for you.

-

Matrix-Like Tagging System: Combine categories with custom tags for flexible analysis. For example, tag a restaurant receipt as "Vacation" while categorizing items like "Restaurant > Drinks" or "Restaurant > Food". This lets you query specifics, such as "How much did I spend on drinks in restaurants during my vacation?"

-

Recurring Transactions: Easily set up and manage repeats for things like rent, subscriptions, or insurance with customizable intervals.

-

Multi-Currency Support: Automatically handles conversions for expenses in different currencies, perfect for travel or international payments. For instance, if you pay in local currency while on vacation but your bank charges in your home currency, Apocha syncs everything seamlessly.

-

Calendar Exports: Generate customizable calendars for upcoming transactions, with reminders based on rules like amount thresholds (e.g., 2-day reminder for under $2,000, 5- and 3-day reminders for over). Even better, use these calendars in your everyday calendar app and get your alarms there.

-

Customizable Dashboards: Build multiple personalized dashboards with widgets for assets, savings rates, net worth trends, income vs. expenses, and many more. Apply filters like date ranges or keywords for tailored views.

-

Hierarchical Financial Accounts: Organize accounts in a tree structure for real (e.g., bank, crypto) or virtual setups (e.g., envelope budgeting with weekly funds or sinking funds for future purchases).

-

Works everywhere: Use it on your phone, tablet, or laptop. Snap receipts on iPhone at the store, analyze on your Windows computer at home, and review with your partner on Android - all synced instantly.

These features make Apocha more intelligent and efficient, turning raw data into actionable financial intelligence without the tedium of manual entry.

Who is Apocha For?

Apocha is ideal for anyone looking to take control of their finances without overwhelming complexity:

-

Students: Track expenses like tuition, books, and social outings while managing limited budgets. (Personal note: When I entered university there were no apps, only Excel 3.0 with these oldschool fancy 3D charts. My 3 biggest spending positions were rent, going out, and photocopier. In that order. But going out included entry fees at the clubs, drinks, food, billard table, and so on. I never had an overview where my money really went.)

-

Young Families: Monitor shared costs, from groceries to kids' activities, with easy collaboration.

-

Freelancers: Handle irregular income, categorize business vs. personal expenses, and analyze cash flow. And most important, get reminders when the quarterly tax payment is due.

-

Anyone Seeking Financial Clarity: Whether you're saving for a goal, optimizing spending, or just curious about where your money goes, Apocha scales from basic tracking to advanced analysis.

If you're tired of generic apps that force compromises and tell you that you spent $630 on "Shopping" last month, Apocha empowers you with precision and automation.

For common questions, check out our FAQ section.