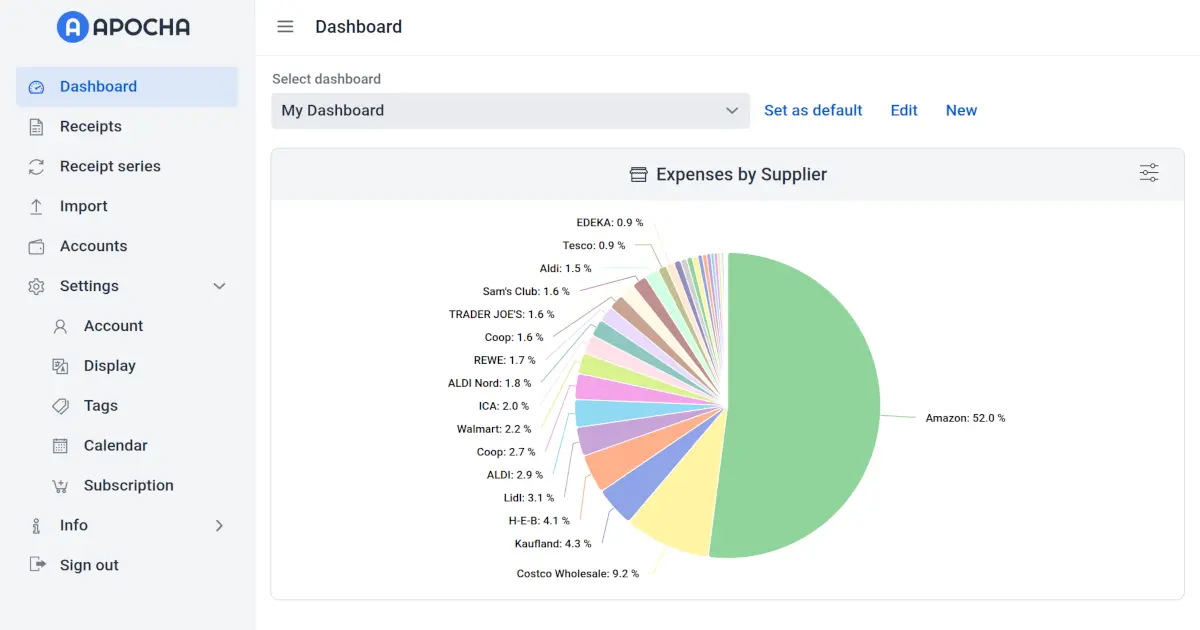

New: Understand Your Spending by Business Category

Here's a question most expense trackers can't answer: Do you spend more at restaurants or supermarkets?

You might see "REWE €450, EDEKA €280, Lidl €190" in your transactions. But that's three data points, not an insight. What you really want to know is: "Supermarkets: €920" - your total grocery spending across all stores.

That's exactly what our new Expenses by Supplier Type widget shows you.